The Cost of Non-Admissibility

When Clarity Becomes Liability

A high-definition image that cannot be proven authentic is not merely useless as evidence—it can become a liability. The presence of clear footage that cannot be verified creates a false sense of security and can lead to worse outcomes than having no footage at all. This chapter examines the real-world consequences of surveillance systems that prioritize clarity over verifiability.

The Risk Landscape

When surveillance footage cannot be verified as evidence, organizations face multiple categories of risk. The following table provides a comprehensive overview of these risk categories and their potential financial impact.

| Risk Category | Description | Typical Cost Range | Frequency |

|---|---|---|---|

| Financial Risk | Direct losses from unresolved claims, settlements, and litigation costs | $10,000 - $500,000 per incident | High (multiple incidents per year) |

| Operational Risk | Inability to establish accountability for employee actions, ongoing losses | $50,000 - $200,000 annually | Continuous |

| Legal Risk | Evidence exclusion, credibility damage, appellate risks | $25,000 - $1,000,000 per case | Medium (1-5 cases per year) |

| Regulatory Risk | Audit failures, licensing issues, compliance penalties | $100,000 - $5,000,000 | Low but high impact |

| Reputational Risk | Loss of customer trust, brand damage, competitive disadvantage | Difficult to quantify, potentially millions | Cumulative over time |

Financial Risk: Direct and Indirect Losses

The most immediate consequence of non-admissible footage is financial loss. In disputes over property damage, theft, or injury, the inability to present verifiable evidence shifts the burden of proof and often results in unfavorable settlements. Consider a property damage claim where clear footage exists but timestamps are inconsistent due to lack of synchronization. The insurance company questions the footage's authenticity, forcing either a reduced settlement or expensive litigation. Legal costs can easily exceed the original claim value, with a $5,000 property damage claim generating $15,000 in legal expenses.

Insurance companies increasingly require evidence of verifiable surveillance systems. Organizations without such systems may face limited coverage, increased premiums, or denied claims entirely. The cost of non-admissibility thus includes not just individual claim losses but ongoing higher insurance costs.

Operational Risk: Inability to Establish Accountability

When footage cannot be verified, organizations lose the ability to establish accountability for employee actions. This manifests in multiple ways: retail organizations cannot address inventory shrinkage when footage lacks verifiable timestamps; manufacturing facilities cannot substantiate safety violations when access logs are incomplete; regulated organizations cannot demonstrate compliance when chain of custody is undocumented. Each scenario requires expensive alternative controls and monitoring systems.

Legal Risk: Inadmissibility and Exclusion

When surveillance footage is presented in legal proceedings, the opposing party will challenge its admissibility if authenticity cannot be proven. Courts may exclude footage entirely if integrity verification is lacking, gaps are unexplained, or unauthorized access is possible. Even if admitted, challenged footage loses credibility and persuasive power. In some jurisdictions, the burden of proof shifts to the party presenting the evidence, creating additional challenges for organizations without verifiable mechanisms.

Regulatory Risk: Compliance Failure

Regulatory bodies increasingly require evidence of verifiable surveillance systems. Compliance audits may fail when footage lacks verifiable timestamps, complete records, or documented access logs. Some industries require surveillance systems meeting specific technical standards—casinos must meet gaming commission standards, financial institutions must meet banking regulations. Failure to maintain verifiable systems can result in licensing denial, revocation, or substantial penalties.

Reputational Risk: Loss of Trust and Market Position

When an organization's inability to produce verifiable evidence becomes public, it damages reputation and market position. Customers and partners expect secure, verifiable surveillance systems. Organizations that cannot produce verifiable evidence lose customer trust, particularly in security-sensitive industries like hospitality, healthcare, or financial services. High-profile disputes create negative publicity, with organizations perceived as either dishonest or incompetent. In competitive markets, verifiable surveillance systems become a competitive advantage.

Failure Scenarios: When Non-Admissibility Becomes Critical

The abstract risks above become concrete in specific failure scenarios. The following table illustrates common failure scenarios and their consequences.

| Scenario | Root Cause | Consequence | Typical Cost |

|---|---|---|---|

| Time Synchronization Failure | Local time without NTP sync, 15-minute timestamp discrepancy | Cannot prove footage is from claimed incident, case becomes disputable | $10,000 - $30,000 legal fees + settlement costs |

| Storage Discontinuity | Storage system failure, missing footage during critical period | Cannot prove completeness, opposing party argues missing evidence | $50,000 - $150,000 settlement increase |

| Access Control Breach | Unauthorized access to footage, no audit trail | Cannot prove footage is unaltered, evidence excluded entirely | $100,000 - $500,000 case loss |

| Export Verification Failure | Exported file lacks metadata and digital signature | Cannot prove exported file matches original, credibility challenged | $25,000 - $75,000 additional litigation |

| Integrity Verification Absence | No checksums or hashes, cannot detect tampering | Opposing party claims footage could be modified, burden of proof shifts | $50,000 - $200,000 case weakening |

Scenario 1: Time Synchronization Failure

A retail organization experiences a theft. Surveillance footage clearly shows a person taking merchandise, but the system uses local time without synchronization. The camera timestamp shows 14:32, while the point-of-sale system shows inventory removal at 14:47. The 15-minute discrepancy raises questions about whether the footage is from the claimed incident. The suspected thief's attorney argues the footage may be from a different time. Without synchronized time, the organization cannot prove the footage's temporal accuracy. The case becomes disputable, forcing either settlement or expensive litigation.

Scenario 2: Storage Discontinuity

A workplace injury occurs, and surveillance footage should show exactly what happened. However, the storage system experienced a failure during the relevant time period, with footage from 14:00-14:15 missing. The organization has footage before and after the incident, but not from the exact moment of injury. The injured employee's attorney argues that missing footage could contain contradictory evidence. The organization cannot prove completeness, weakening their defense and increasing settlement costs.

Scenario 3: Access Control Breach

A dispute arises over a contract performance issue. Surveillance footage could resolve the dispute, but the system's access logs reveal that multiple unauthorized users accessed the footage storage system during the relevant period. The opposing party argues that the footage could have been modified or selectively edited. Without comprehensive access auditing and tamper prevention, the organization cannot prove the footage is unaltered. The court excludes the evidence entirely, resulting in case loss.

Quantifying the Cost

Organizations can quantify the cost of non-admissible evidence by analyzing their incident history and risk exposure. The calculation framework considers incident frequency, average claim value, resolution success rate, and litigation costs. A typical mid-sized organization might experience the following annual costs from non-admissible surveillance footage.

| Cost Component | Annual Estimate | Notes |

|---|---|---|

| Unresolved Claims | $75,000 - $200,000 | 5-10 incidents at $15,000-$20,000 average loss per incident |

| Litigation Costs | $50,000 - $150,000 | 2-5 cases requiring legal defense |

| Increased Insurance Premiums | $10,000 - $30,000 | Premium increase due to unverifiable systems |

| Operational Losses | $25,000 - $75,000 | Ongoing theft, safety violations, compliance issues |

| Regulatory Penalties | $0 - $500,000 | Infrequent but high-impact audit failures |

| Total Annual Cost | $160,000 - $955,000 | Varies by organization size and industry |

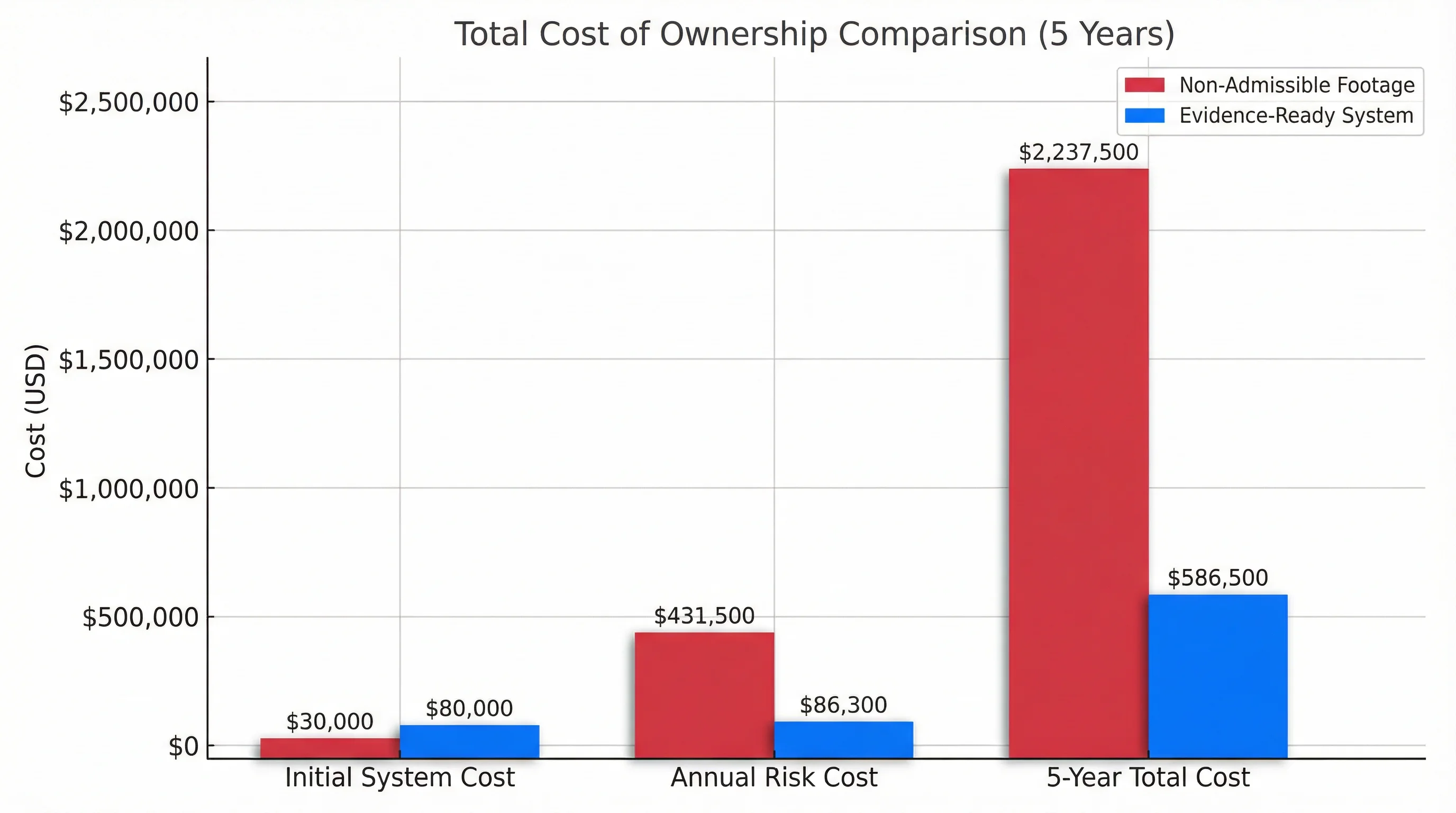

The Investment Case for Evidence-Ready Systems

The cost of non-admissible evidence provides the business case for investing in evidence-ready surveillance systems. If an organization faces $160,000 to $955,000 in annual costs from non-admissible footage, an investment of $50,000 to $150,000 in evidence-ready system upgrades is justified. The payback period is typically less than two years, with ongoing annual savings thereafter.

Organizations must shift their perspective from viewing surveillance systems as observation tools to viewing them as evidence platforms. The incremental cost of evidence-ready features—time synchronization, integrity verification, access auditing, and export verification—is recovered through reduced losses, avoided litigation, and improved dispute resolution. The cost of non-admissibility far exceeds the cost of evidence-readiness.